CCR Gives to DCF 2023

We are so proud to have been able to gift 10 boys and girls in DCF care a complete outfit and a toy this holiday season!

Tips for Safeguarding Your Identity Online

Learn the risks associated with divulging your personal info and the steps you need to take to mitigate them below.

The Importance of 529 Plans

Find out how a 529 plan fits into your family’s financial and college plan!

A Quick Primer On Living Wills

Consider implementing a living will to ensure you’re protected in case of the unexpected.

CCR Attended the Annual Worcester Women’s Leadership Conference

On May 4th, some of the brightest women of CCR attended the Annual Worcester Women’s Leadership Conference!

Retirement Planning Does Not Stop in Retirement

Unexpected costs, such as family emergencies, will occur in retirement… that’s why your retirement planning needs to incorporate more than just investments.

Building Generational Wealth With Hard Assets

One of the most effective ways to build generational wealth can be through investing in hard assets that hold their value – and offer long-term growth potential.

Five Questions to Ask Before Retiring

You might be thinking about retiring, but how do you know when you are really ready for it, mentally and financially?

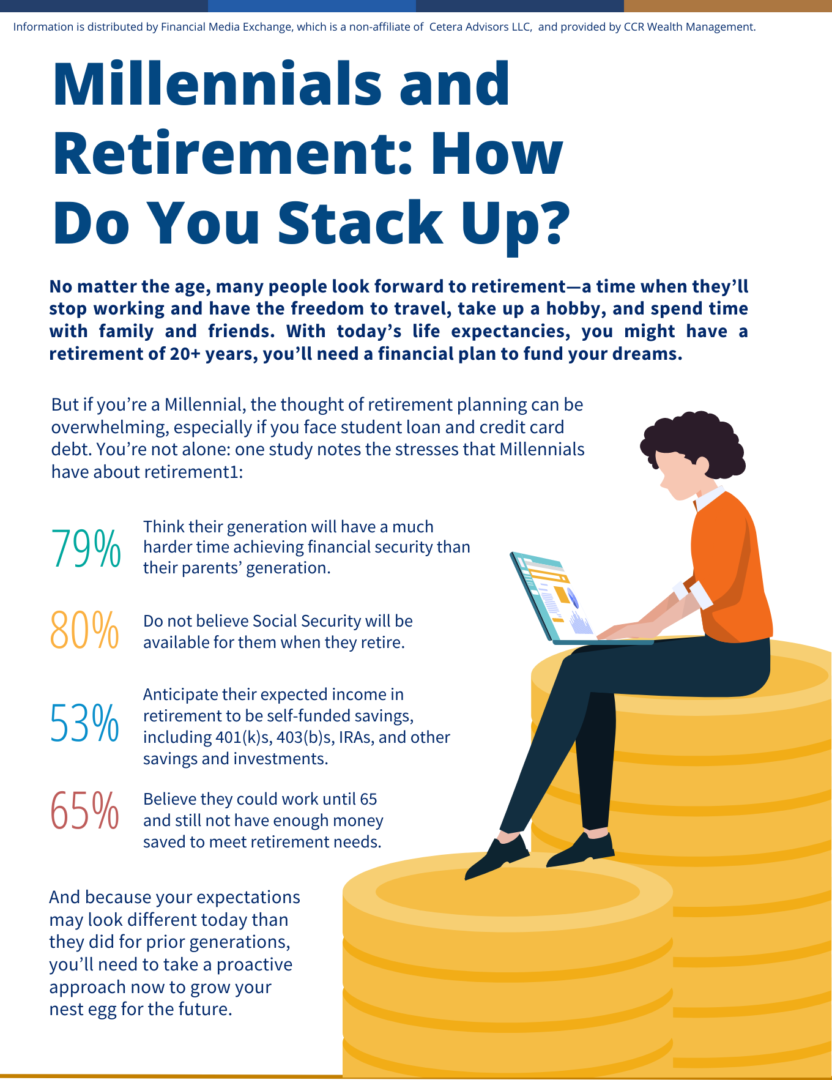

Millennials and Retirement: How Do You Stack Up?

If you’re a Millennial and not already contributing to a retirement account, consider starting now, especially if your employer offers a matching program.

January 2023 Market Outlook

While we look forward to 2024 as a Year of Normalization, as investors we recognize that plans are useless, but planning is essential.

October 2022 Market Outlook

The time is now to pivot portfolios that are still smack of yesteryear into more durable mediums of long-term growth.

June 2022 Market Outlook

The case for a near-term recession has been made incessantly in the media of late. While we believe that indicators like Consumer Sentiment, inflation the Federal Reserve’s aggressive attempts to correct a clear policy mistake have raised the odds of recession, we do not believe it is imminent in the near term. So, we will give a couple of points to bolster the other side of the argument.

July 2023 Market Outlook

The second half of 2023 is likely to be less celebratory than the first half has been. Don’t fight the Fed!