July 2023 Market Outlook

Our thesis for the first two quarters was that due to our skepticism that the Fed was done hiking interest rates (they’re still not done), a “churning” among sectors within the broader averages would likely continue to produce a “saw-tooth” pattern in major indices, with little overall advancement. But we also held that our expectations were etched “in pencil” given the increasing bifurcation in economic signals (backward-looking data vs. survey data), economists outlooks, and our own supposition about interest rates and their ultimate influence on the economy. In short, we thought (and still do—but with even less conviction) that the second half of this year was likely to look much different than the first quarter.

Now, ten days into this second half, we may soon see which argument prevails. Given our assumptions that more defensive names and sectors would inevitably shine relative to their growth counterparts in the face of recessionary expectations we must concede, at least to this point, that we were either wrong, or early. Being wrong and being early look identical, for a period, at least. But as stated in April, as investors we must be prepared to shift, change our minds, and adjust as new information becomes available—more on this later.

Adjusting, however, comes with its own risks. In behavioral finance terms, we need to balance the risks of anchoring ourselves to an original assumption (despite new information), with that of abandoning reasoned assumptions because we are in a funk about an expected outcome has not come to pass…yet. Are we adjusting towards a current market reality? Or would we also be adjusting away from economic eventuality (slow as it can be for this to set in)?

Let’s review three highlights from the second quarter:

Highlight 1

Earnings: According to Factset, the second quarter estimated earnings decline for the S&P 500 is -7.2% from Q2, 2022 levels. During the same quarter, the S&P 500 rose 8.74%.

Quarterly earnings releases are rear-view mirror data, while stock prices supposedly reflect future expectations. So, the future appears rosy, despite a sharp decline in earnings from the prior year—according to the S&P 500 anyway. No doubt that over the previous twelve months profit margins were pinched by supply chain woes, the increased price of raw materials and let’s not forget, rising wages. Also, much of the narrative surrounding earnings during the quarter was their resiliency. Few huge misses. But what rarely gets mentioned is the fact that expectations for earnings for the quarter were reduced by almost 3% from the prior quarter.

Our perspective on corporate earnings has not changed, and in the near term we believe “long and variable lags” of monetary policy will continue to exact a price. The price is more likely to be felt by more fragile balance sheets and income statements impacted by today’s comparatively high cost of capital—so a certain unevenness in market outlooks is warranted. We have just begun the Q3 earnings season, so again, we shall see. According to Reuters, analysts expect a -5.6% decline in earnings from Q3 last year.

Highlight 2

Our second highlight from the quarter is, to us, the more frustrating paradigm. The promotion of “everything AI” began with the introduction of ChatGPT back in November. This promotion reached hype-status (in our view) with the May release of earnings of a single semiconductor company, catapulting it into the exclusive “Trillion Dollar Club” within the S&P 500. Indeed—we could point to this event as the catalyst which effectively replaced the prevailing “saw-tooth” market pattern with that of a trending index.

Why do we call this a “frustrating paradigm”? We have some experience with hype in the markets—both justified and unjustified. In both cases, hype tends to take investors’ attention away from important risk factors which should inform opinions and expectations that are (at least) equally relevant to foreseeable returns. These factors include things like sales, earnings (or potential earnings) and interest rates. Readers know we’ve poked fun at many examples of hype, including marijuana stocks, block-chain and EV’s. The true limits of potential in these stocks—and even industries—is drowned-out by breathless repetitions of “new paradigm” analysis and narratives. That marijuana stocks can’t even engage in the regular national banking system due to federal laws that show no sign of changing—pay no mind. That few people who jumped head-first into the block chain hyperbole can even tell you how exactly this technology benefits an existing business model doesn’t stop CEOs from trying to place themselves “adjacent” and as “leveraging” it every time they’re in front of a camera (not so much lately since that bubble deflated). That the US electric grid has not the capacity (and little movement in the direction of building it) to support the breathless narratives of how we’re all going to be driving electric cars in ten years—a minor detail. Of course, we’re not predicting the demise or death of any of these industries. We only point out the myopic, cognitive dissonance that investors tend to exhibit when the hype-machine is in full throttle.

Image source: https://en.wikipedia.org/wiki/Matterhorn#/media/File:Matterhorn_from_Domh%C3%BCtte_-_2.jpg

We display a nearby image of the Matterhorn because it is a reasonable shape proxy for the chart of many (even most) IPOs and ETFs that were produced by the hype in all these industries. Wall Street loves hype.

Of course, not all narrative is hype, and even some instances of hyper-promoted technologies come true!

One obvious case in point is the advent and development of the internet back in the 1990’s. Stocks of companies developing routers, servers, storage, broadband and fiberoptics went ballistic! The narrative was no less sensational: “B2B”, “VOIP”, “e-commerce”, “4g” were the buzzwords regularly cited as inevitably revolutionizing how we would do business, shop, entertain, and communicate. Efficiencies would drive down costs, improve productivity, etc.

Guess what?

This narrative was entirely UNDERSTATED! While anchors on MSNBC were blathering on about the importance of something called “voice-over-internet protocol” and Pets.com, somewhere in a lab in Cupertino, CA the iPhone was on the drawing board. And no one even knew.

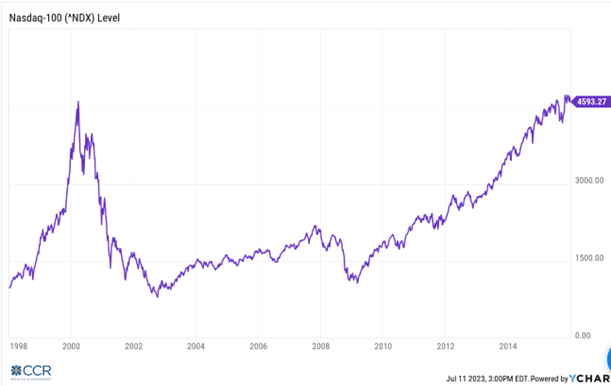

Guess what else? While all this revolution was being turned into reality, coming true in ways greater than even imagined back in the ‘90’s, the NASDAQ 100, the index on which most of these innovators resided, collapsed by over 80%! And took 15 years to revisit the highs of the hype.

So that there is no misunderstanding, we are firmly in agreement that artificial intelligence will be a profoundly important technological evolution! Given the media saturation, we won’t go into all the areas of impact, except to agree that it will be transforming across all aspects of our economy, our lives, and perhaps even our life expectancy. This transformation, in our view, will at least rival that of the “digital” and internet revolution of the 1990s, and ChatGPT is simply the opening act. Furthermore, it is not a question of what companies will adopt AI—to the extent they can. The reality, much like the internet, will be that virtually all companies who want to survive in the future must adopt AI.

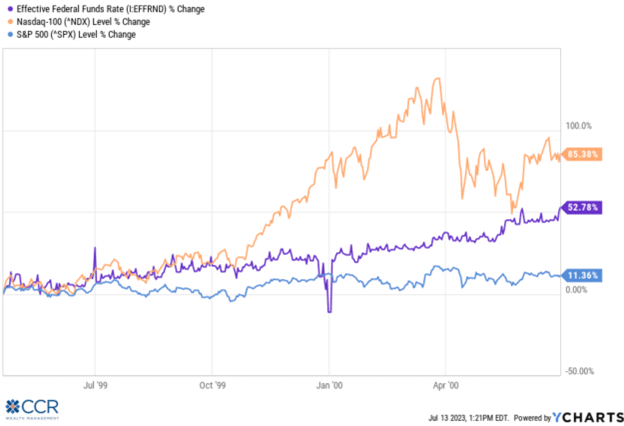

Our point, and the point of our caution here, is that markets tend to pull returns forward when the environment is saturated with monolithically bullish outlooks. Domination by a single sector, or even a single handful of stocks pushing markets averages to ever new heights—we call this “narrow market breadth”—does not, by itself, bring markets down. To this we would add that this condition can last for years (for reference—again see the late 1990’s). But based on history as well as personal experience, it can cause markets to be brittle, and eventually less resilient to that unforeseen risk that comes out of left field. Risks abound in this market—but they always do. Of all the axioms, rules of thumb and corny Wall Street idioms we’ve picked up over the course of our career, one seems both frequently ignored, but consistently true. That idiom is: “Don’t fight the Fed”. Then, as now, we had a Fed Funds rate marching higher, and a narrow grouping of stocks carried the broader market higher.

The past is there to learn from but expecting it to be repeated without variance is folly. Markets continued in this condition for some years back then. It was a confluence of events completely untied to the “digital narrative” which shook the confidence of investors. The Enron & Worldcom scandals, along with the terrorist attack of 9/11/2001 were the unforeseen risks then, which also illustrated to investors in unfortunate detail just how many years of return they had pulled forward.

Highlight 3

Our last point of note from the quarter has to do with the minutes released from the Fed’s June FOMC meeting. This meeting, as widely telegraphed, did not result in a rate hike. The minutes did, however, reveal that consensus outlooks include more rate hikes ahead. The minutes were released on July 5th, and the ten-year Treasury yield promptly jumped above the 3.85% range that had capped it since mid-March, briefly rising to 4.09%. Recent news of the continued decline in CPI to an annualized rate of 3% through June reversed this interest rate spike. That’s the numerical minutia of the quarter.

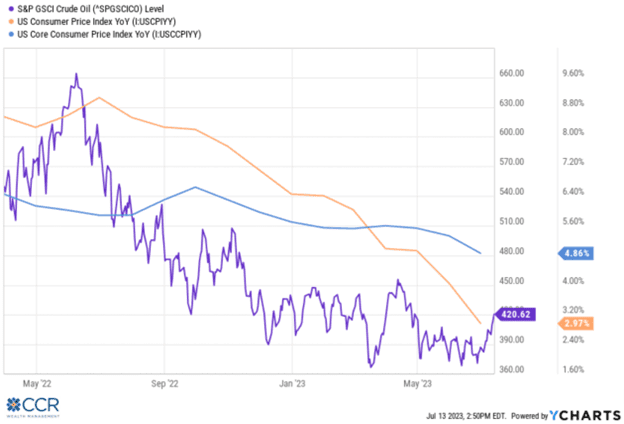

We see reasons for both caution and relief. The good news of course, is that CPI has continued its downward trajectory from a peak of 9.1% a year ago. This is a clearly positive economic catalyst (or a significant reduction to an economic impediment). Make no mistake, though, that most of the decline from last year has been derived from the reduction in the price of food and energy components. As we pointed out in April, the Fed has no influence over the price of food and energy, and largely dismisses headline CPI from their calculations.

Core CPI (CPI stripped of food and energy) has fallen, but much more modestly, having declined to 4.86% from a year-ago level of 5.9%, and a peak of 6.6% last September. We are more concerned with this number because the Fed is more concerned with it.

“The last mile is the hardest”—so the saying goes. With supply chains having largely been ironed out and the price of crude oil nearly 20% cheaper than it was a year ago, we see a risk that higher inflation gets embedded into the economy if the Fed doesn’t continue to ratchet up the monetary pressure. This would be the last legacy any Fed Chair would wish to leave when their tenure is up. So, while market consensus has finally ditched the absurd notion (in our view) that rate cuts will begin this year, it has been replaced with another consensus that we also resist, and that is the coming July rate hike will be the last. Our remaining mile in terms of inflation consists of two particularly stubborn areas of the economy. The first is wage inflation. Wage inflation is “sticky”, and the only way to deal with it is through significant levels of employment loss. The second area concerns “shelter inflation”: the cost of rents and rental equivalents. The persistent housing shortage in this country will make the shelter inflation conundrum persistent. Mortgage rates have gone from below 3% to above 7% in the span of about 18 months. If this hasn’t dented the housing market, it’s difficult to imagine what will short of 1) time—a lot of it, or 2) massive layoffs.

Conclusion

Our market view has actually changed little since we sent our April Outlook. We are more pessimistic than the bulls driving the AI train, but we are not pessimists in the general sense either. If our outlook for equities was overly conservative in the first half of the year, our expectations from the Fed have thus far panned out—the market has come to us on this latter point. In that vein—we have also taken modest steps (half-heartedly) towards where the market is in other areas.

Our Strategic model portfolio has replaced the S&P 500 equal weight holding with the more common market-cap weighted holding. Additionally, and more recently, this same model has added to US small caps, drawing down from our large cap value exposures (the latter remaining unloved thus far this year). Importantly, however, our models remain “more balanced” than the broad US equity markets have been this year, and we are not placing a large footprint in the AI camp. In short, we have not abandoned our concerns from earlier in the year just because they haven’t panned out. We understand that “imbalanced” markets can persist. But given the weight of massive rate hikes (which haven’t ended yet)—we think investors would be most prudent to adjust expectations going forward rather than portfolios. The second half of 2023 is likely to be less celebratory than the first half has been. Don’t fight the Fed!

Follow us on social media for more timely content delivered directly to your news feed!

The views are those of CCR Wealth Management LLC and should not be construed as specific investment advice. Investments in securities do not offer a fixed rate of return. Principal, yield and/or share price will fluctuate with changes in market conditions and, when sold or redeemed, you may receive more or less than originally invested. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Investors cannot directly invest in indices. Past performance does not guarantee future results. Additional risks are associated with international investing, such as currency fluctuations, political and economic stability, and differences in accounting standards.

Registered Representatives offering securities and advisory services offered through Cetera Advisors LLC. Member FINRA/SIPC., a broker/dealer and a Registered Investment Advisor Cetera Advisors LLC and CCR Wealth Management, LLC are affiliated. Cetera Advisors LLC does not offer tax or legal advice.

1800 West Park Drive, Suite 150 Westborough, MA 01581