Protect Against a Scorching Market

The stock market is experiencing its own form of a heat wave. Here’s how to protect your wealth from the financial heat.

Women Approach Investing Differently

Men and women approach investing differently. In general, women’s investments outperform men’s. Why is that?

The “Average” Benefit of Dollar Cost Averaging

Over time, dollar-cost averaging may lower your average cost per share versus one-time big-time investing.

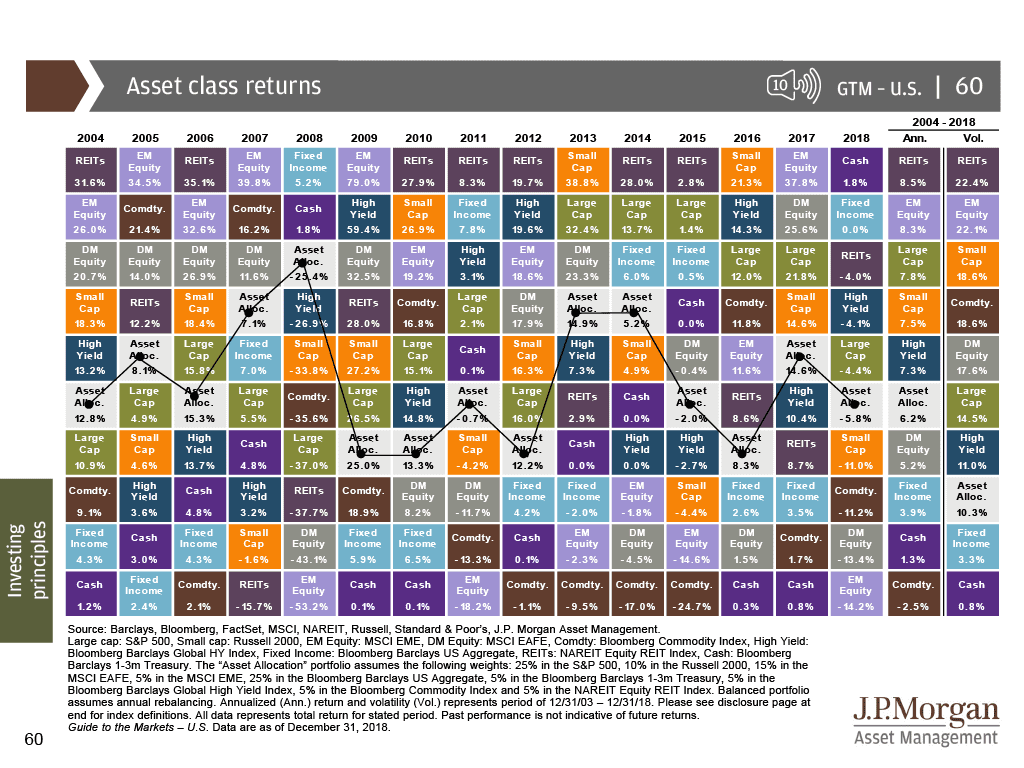

The Importance of Diversification

Retirement Consultant Jared T. Evangelous, CRPC®, discusses the importance of diversification.

Diversification & Correlation

Investors need to know the difference between diversification and correlation, as your diversification strategy may not work as you intended.

Diversification & Small Business

As a small business owner, there’s a good chance that your diversification strategy may not work as you intended.

How Diversification Can Help Small Business Owners Manage Risk

We hear all the time that spreading our portfolios’ holdings across many asset classes is the best defense against losses when the bears hit Wall Street. But as a business owner, there’s a good chance that your diversification strategy may not work as you intended. Here’s why.

How A Financial Plan Helps Endure Market Volatility

Learn how financial plans incorporate market volatility and why building a durable plan is essential for reaching your financial goals during market downturns.

Dollar-Cost Averaging

What is dollar-cost averaging and how can you implement it in your investment strategy? Financial Planning Associates Vincenzo Palmerino and Tim Ressler discuss this simple investment strategy.

Behavioral Finance & Market Outcomes Ebook

Behavioral biases have a proven, negative effect on investor outcomes. We draw from the annual Dalbar Quantitative Analysis of Investor Behavior report in quantifying their effect on individuals’ portfolio returns, and explore both Cognitive and Emotional biases as well as discussions of specific behaviors common among investors.

Corporate Bond Market

The corporate bond market has gotten riskier. Why? What should we do in our portfolio?

Setting Client Expectations in a Volatile Investment Environment

As volatility becomes the norm and double-digit gains become an anomaly, it’s time to boost your contacts with your clients to keep them content.

Why Advisors Should Keep Politics Out of Portfolios

In Keeping Politics Out of the Portfolio, published on ThinkAdvisor.com, Jonathan Albano talks about the importance of taking a clients politically fueled emotions out of their investing strategy.

Diversification: Blending Your Investment Ingredients

Your portfolio’s potentially high rates of return can skew one’s objectivity, resulting in unnecessary exposure to risk.