October 2022 Market Outlook

We titled our June Outlook “The Age of Indulgence is Over”. We tried to hammer home the point with examples as specific as we can get in this publication, beholden to compliance limitations as we are (meatless meat and exercise bikes among them.). As if on cue—markets rallied into August, with technology and other related growth issues outpacing the broader averages. Alas, old habits die hard. For our part, we are not surprised the rally ended and large swaths have since edged to new lows. Beware that the indulgence trade’s last gasps may continue, until investors are sufficiently discouraged (more on this later).

Behavioral Finance studies have shown that one of the most important disciplines investors should focus on is the evaluation of the future—apart from what has transpired in the recent past. That is, expectations should be centered on assumptions from today going forward. The past can and should be learned from, of course, but it has no predictive power to inform us of what the future brings. Both the SEC and FINRA require all financial advertisements disclosures and commentary to state clearly that “past performance is not indicative of future returns”. Yet, in our view, it is the past on which many investors dwell.

Human beings are not computers, and emotional baggage accumulated from the past (whether greed-based or fear-based) often shades our expectations of the future, and we act (invest) accordingly. Recency Bias is one of several sub-conscious maladies that lead to sub-optimal portfolio outcomes. It is for this reason (among several) that behavioral finance, the study of what people should do versus what people do is an important discipline.

On this point, we wish to continue to drive home our investment theme laid out in January of this year. Our point was (and remains) that global markets have entered a new age, a new era, and that the last paradigm is a relic. The last paradigm, of course, was the era of “helicopter money”. This was monetary stimulus supplied not just by the Federal Reserve, but by central banks around the world. This era saw any whiff of economic nervousness, no matter how thin the evidence, answered with the “warm wet blanket” response of easier money: lower interest rates, negative interest rates, quantitative easing along with dovish murmurs from the Fed. Driving the denominator in any valuation model toward zero has an upwardly explosive effect on valuation. In addition, private equity firms feasted on these extraordinary rates to fund all manner of ventures which relied on metrics such as Active Monthly Users, subscriptions, and of course revenue to catch the eyes of Wall Street. Profitability—or a clear path to it—often went by the wayside. In this environment, “concepts” flourish. Quality, generally, treads water.

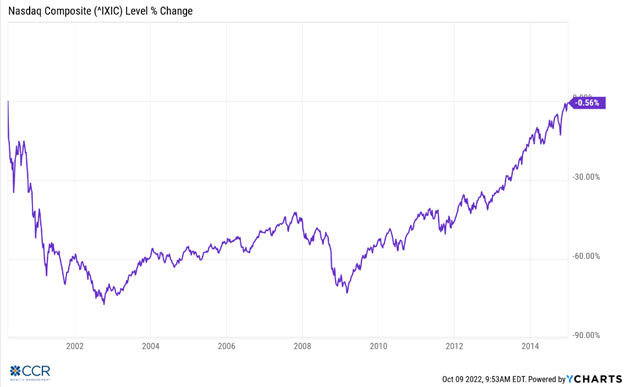

Many of us have seen this movie before! Sure—it is a little different this time…it always is. History doesn’t repeat—but it rhymes. The Dot-Com bust began with the NASDAQ Composite Index peaking in March of 2000 and falling a cumulative 75% over the next year and a half! But here is the most important part of this walk down memory lane, and the most germane to our observations that investors can be too slow to react to new realities: The total return of this same index did not break even with its March 2000 levels until late-December of 2014! That’s right—nearly 15 years.

It can be argued that most investors have about 40 years of potential growth and accumulation investing before monetizing this portfolio for income purposes in retirement. Risk must play a role during this period to produce returns—usually more risk in the earlier years and less as time goes on is the typical model. The nearly 15-year period outlined above is over 1/3 of a typical investor’s growth horizon (not the same as the time horizon). Investors who could not bring themselves to recognize the new era, the new paradigm, and who pointlessly waited until their artificial “price targets” or “break-evens” were reached wasted precious time.

The market’s June resurgence in growth and technology stocks illustrates a broad-based reluctance to recognize this new era, this paradigm of longer-term inflation, and a more extended period of higher interest rates that is before us. Forecasts that the Fed will “pivot” to a dovish policy lack any evidence (and are in significant contrast to the Fed’s very hawkish comments of late).

We have published on the topic of Behavioral Finance, and if you have had an opportunity to read the work or watch the videos, you know that the behaviors described above have elements of Recency Bias, Anchoring and Adjustment, and Conservatism. These biases all fall under the rubric of Cognitive Dissonance. Investors understand that something is afoot—but it's often easier for us to assign blame (The Fed, the Politicians, etc) than to spend the mental capital required to make meaningful changes to a portfolio. We’ve read plenty of rants that have come across our inbox—but in the end, these are distractions, at a time when investors need focus. It is also easier to tune into bullish/dovish forecasts and outlooks than it is bearish/hawkish forecasts and opinions. Yes, the “chickens have come home to roost” for central banks around the world. So what? Will that acknowledgment return your social media stocks or blockchain ETFs to favor? Yes, you acknowledge that you’re “a long-term investor”. But companies in your portfolio may not be around in the long term. Others may be well on the way to a 15-year Dark Age. Does this comport with your financial plan? The time is now to pivot portfolios that are still smack of yesteryear into more durable mediums of long-term growth. Portfolio return expectations should also no longer be colored by yesteryear’s interest rates and equity returns, but by a reasonable spread between nominal returns and inflation rates. In short, THERE ARE NO SACRED COWS!

One last note on this topic: taxes. One barrier investors often place between themselves and a more durable portfolio is an aversion to paying capital gains taxes. Make no mistake, Wealth Management requires a holistic approach, with attention paid to portfolio risks and returns as well as tax efficiency—both within the portfolio and in conjunction with outside assets/activities. But we write from the perspective of portfolio management. An investor who overweights themselves in one industry, one sector, or one stock in a taxable account, and who has no expectations of recognizing success (and paying the tax that comes along with it), will likely see that success turn into something else over time. No one likes taxes, but they are a reality. Investors should assess portfolios in after-tax terms. Investing in equities in a taxable account will eventually result in taxes owed, or risk long-term “round-tripping”—meaning investors sell only after it has become clear that former gains will most likely never be seen again. Often this can take decades. Unfortunately, this is an occurrence we have often seen in our careers.

Equities:

Earnings season is upon us. We find the ongoing debate about whether or not the US is going into a recession curious—only insofar as the debaters had already previously agreed that two consecutive quarters of negative GDP growth constituted just that! —a recession! Truth is, as with the broader indices, a single number (like an index return) tends to hide relevant facts. Q1 & Q2 GDP figures have been confirmed in negative territory. Turning to corporate earnings (often a harbinger of things ahead for labor markets), through June of this year, S&P 500 earnings growth was negative—save for the energy sector (we’re not referring to solar panels and windmills here). Keep in mind: these days, energy represents less than 4% of the S&P 500. So, indexers have little to hang their hat on. Less than 4% of the S&P 500 has kept the earnings growth positive. Until this quarter’s reporting is done, we surmise. We haven’t written much about exchange rates this year, but clearly the soaring US Dollar adds further pressure on earnings. Will lower earnings (and forecasted earnings) convince the talking heads that we’ve been in a recession all along? We doubt it.

We laid out our playbook in January. In terms of equities, we pointed out that investors should be focused on value, not growth. Investors should be focused on large-cap, not small cap. Investors should be focused on quality, not concept. Our additional coloration in June outlined indulgences of narrative and storyline that lead investors to the premise that “this is the next big thing”—which nothing can derail. Investors should focus on being defensive in the equity markets today. CCR Wealth Management has executed this tilt throughout our discretionary client base already—to the extent we can. Many clients continue to have significant capital gains in their growth holdings, and while we have been busy at working to realize losses throughout the year—these positions should be a centerpiece of conversation with your financial advisor. Unfortunately, we have often witnessed profits swapped for favorable tax-bills.

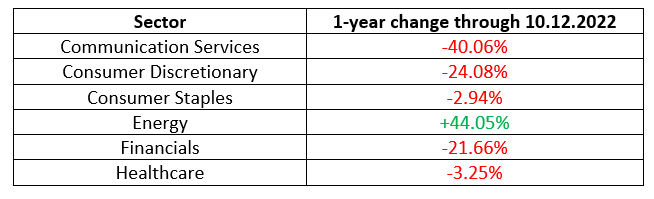

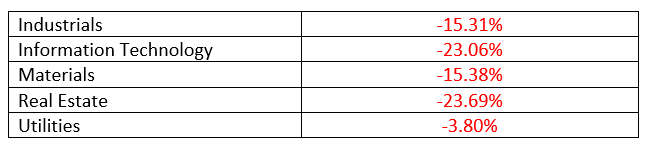

We favor the defensive sectors of Healthcare, Energy and Consumer Staples. Having already declared earlier that the past doesn’t predict the future, perusing the GICS sector performance below we would suggest that the recent past could be indicative of the immediate future in so far as the macro-economic conditions that produced these returns is likely to persist.

Whether it is Recency Bias, Anchoring, or Conservatism, hope springs eternal that the Fed is already thinking about its path to easing conditions in the year—or even quarters ahead. We do not share this optimism.

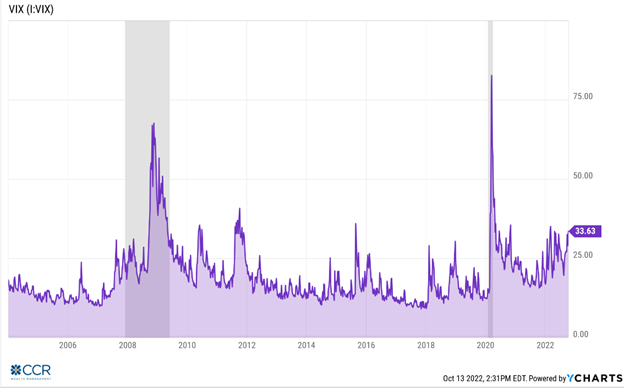

One pattern of bear markets that tends to repeat is a crescendo of selling so violent, so capitulating, that one can easily see the spikes in the VIX index, an option-based index used to quantify market volatility. Nearby we show the VIX for the last seventeen years, which includes the previous two recessions. While we have seen a slight and consistent elevation in volatility over the previous year—missing has been the capitulation, a usually short (and sometimes terrifying) period where investors all throw in the towel. In this chart, you can see the VIX crescendo that accompanied the Financial Crisis of 2008-2009 and the pandemic of 2020. Capitulation often marks the beginning of a new market cycle, and many bulls wait for these bear-market moments to occur before plowing money back into the market. To us, the lack of capitulation in this market to date is evidence of continued complacency by investors (individuals as well as institutional). Complacency in expectations that the Fed will eventually come to the rescue—again.

While we continue to emphasize value over growth, quality over concept, ect., we must also condition ourselves for the possibility that this period lasts longer than most expect. The awaited for “V”-shaped recovery in the markets will, in fact, be more like a longer series of “W”s. In this type of market, dividends are important, and should be emphasized within your value allocation.

Fixed Income:

While we are prepared for a sideways “slog” in the broad equity indexes, we find ourselves in the unusual position of being somewhat excited about the return profile of much of the bond market these days. It has been many years since bonds have been poised to surprise on the upside—but it has been many more years since investors could receive an actual income stream while they wait!

Make no mistake: After September’s disappointing inflation data release (CPI + 8.2%, Core CPI [less food and energy] up 6.6%), it should be clear that the Fed will likely plow ahead with another 0.75% rate increase next month. BUT! Much of this is already priced into the bond market, with the broad-based Bloomberg US Bond Index down over 15% year-to-date.

As we consider the moves already made by the Fed, we think it is important to emphasize the lagging nature of interest rate increases. Recall from our last Outlook: The market is not the economy (and vice versa). Rate increases by the Fed (and for that matter, all manner of pressers, speeches, and data releases) tend to have an immediate impact on the capital markets. Traders and investors quickly adjust their positioning based on these indicators. We would also add that the mortgage markets are also quick to react. However, the actual restrictive effects of higher interest rates intended by the Federal Reserve take time to seep into the economy. Most estimate a six-month lag between a rate move by the FOMC and its desired effect on the economy. So—the first 0.75% rate increase in June isn’t factored into the current economic activity here in October. But such a historically massive series of rate increases as we have had this year will have the Fed poised to take its foot off the brake pedal early next year. Have we contradicted ourselves here? We just finished underscoring our opinion that rates will not be coming down anytime soon! No! Taking your foot off the brake is not the same as hitting the gas. We firmly believe the Fed will need to pause because they make forward-looking decisions on interest rates using mostly rear-view-mirror data input. The lag effect will require a period of observation to see how their policies are impacting the economy (and importantly, inflation). It is this pause that we feel could start the bull market for bonds again.

In the absence of any broad-based credit issues, bonds are more easily identified as a fair value at current levels than stocks. We are not calling a bottom in the bond market, however, we are now being paid handsomely for our patience. We see the risk/reward outlook for much of the bond market as being superior to broad-based equities for the next 6-12 months.

On a last note, CCR Wealth Management’s model portfolios have maintained higher levels of cash than is usual this year. In addition, our Managed Futures allocation back in the Spring has, as intended, provided an element of ballast to the volatility in both the stock and bond markets. Cash levels have slowly been drawn down in the third quarter and will continue to be incrementally allocated into the model components. Please do not hesitate to contact your advisor if you have any questions about your portfolio—or even if you wish to converse with a member of our investment team for a deeper dive into your portfolio.

© 2020 CCR Wealth Management, LLC

The views are those of CCR Wealth Management LLC and should not be construed as specific investment advice. Investments in securities do not offer a fixed rate of return. Principal, yield and/or share price will fluctuate with changes in market conditions and, when sold or redeemed, you may receive more or less than originally invested. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Investors cannot directly invest in indices. Past performance does not guarantee future results. Additional risks are associated with international investing, such as currency fluctuations, political and economic stability, and differences in accounting standards.

Securities and advisory services offered through Cetera Advisors LLC. Member FINRA/SIPC., a broker/dealer and a Registered Investment Advisor Cetera Advisors LLC and CCR Wealth Management, LLC are not affiliated companies. Cetera Advisors LLC does not offer tax or legal advice.

CCR Wealth Management 1800 W. Park Drive, Ste 150, Westborough, MA 01581. PH 508-475-3880 / 72 Queen St, Southington, CT 06489. PH 860-370-2270