January 2023 Market Outlook

Frequently in January, we point out that CCR Wealth Management is not in the business of forecasting. It is much more fun to judge and cast dispersions on the forecasts of others, in our opinion-with the benefit of hindsight, of course. This is the season for grading such forecasts. That said, and recalling the words of Dwight Eisenhower, "Plans are useless but planning is indispensable" a quick review of our suppositions last January should be fun. As we pointed out a few Outlooks ago, more than a dose of humility is required in our role.

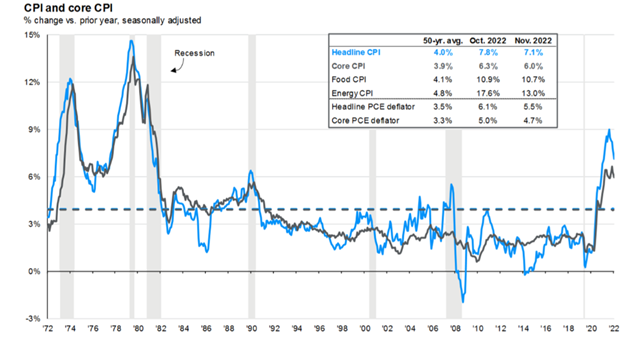

First, we deemed 2022 would be a year of change. While not overtly stated last January, we anticipated significant change in the country politically, but we got modest change instead. We anticipated a "significant reduction in inflation from current levels". Well, that was written when the CPI (month-end November 2021) yoy level was 7.00%. The index level has dropped some 21% from its highs in 2022 (from over 9%), but to a level of 7.1% (yoy November 2022). We also suggested that we expected the Fed to "pause" their rate-hike cycle towards the end of last year. We were dead wrong on this last one (though "pause" is in the air today, possibly in the next two quarters). Not only did the Fed not slow down, but the magnitude of rising prices begat a commensurate magnitude in rate increases. And lastly, we anticipated a steepening of the yield curve as the year progressed-instead we got an inversion of the yield curve last Spring, which has been with us since (where shorter-term spot rates exceed longer-term spot rates). This term structure has been said to be a harbinger of inevitable recession-though the definition of recession itself has become quite fuzzy of late.

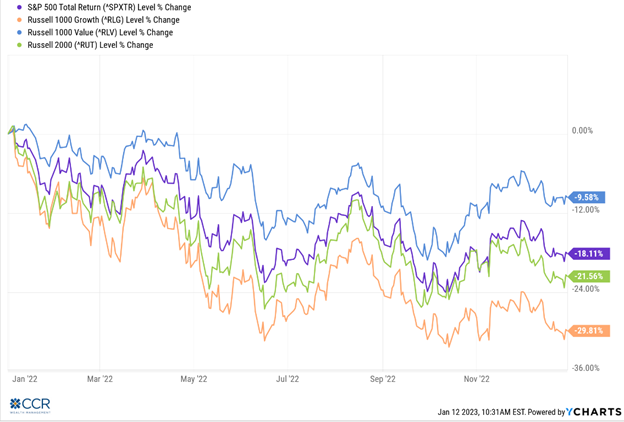

On the other hand, other expectations have panned out-if only on a relative basis. We expected an increase in market volatility on account of a hawkish Fed, and on this score, markets did not disappoint (stocks and bonds). Large caps outperformed small caps, if only just a little. But value meaningfully outperformed growth by about 20%, and while "concept" stocks are less easily defined by an index, the meltdown in crypto, blockchain, SPACs, and frankly any industry which blossomed and flourished under the last cycle's permissive interest rate levels was utterly flattened, while "quality" cashflow-generators generally outperformed the market.

500 words into this Outlook and we think parsing the details of last year any further is likely unproductive. 2022 has left an indelible mark on many of us (akin to 2008, and perhaps 2001). As always, the question which should be pondered is, 'What Have We Learned?'

Here is a summary of some lessons that come to our mind:

- "Plans are useless, but planning is indispensable". Understand that being a "long-term investor", while necessary to achieve long-term financial goals, should not place your feet in cement. Investors should invest reflectively, not reflexively. Markets move in cycles-they always have. We pointed out in October that the NASDAQ Composite Index took 15 years to break even after the Dot-Com bubble burst. The broader-based S&P 500 accumulated an 80% return over this same period. If your largest holdings are out of favor and have declined 50%, 60%, or 80% over the last year, do not assume they will be market leaders in the coming year, or years. It's time to get serious.

- A $0 tax bill applies to investors who do not gain from their investments.

- Beware the Celebrity CEO(s). Beware the Founder-CEO(s). The "G" in ESG stands for Governance. In our view, this is where investors should commit their attention and resources, yet this is the area least scoured by the financial media and investors.

- Never underestimate the potential impact of geopolitics on the markets. We feel this will be increasingly important in the years ahead as globalization increasingly becomes regionalization, and strategic competitors become military opponents. While supply chains have largely undergone normalization over the last year, their continued fragility should be well understood by investors in this context.

- Don't fight the Fed. This is ancient market wisdom, but it hasn't sunk in for many market participants.

A recurrent theme in the media over the last few months has been the "demise" of the 60/40 portfolio. We read two separate articles in the Wall Street Journal on the subject in just the last three months. In fact, this theme has been with us for much longer. The premise itself was born out of the "financial product factories" on Wall Street roughly 20 years ago. Not content with the declining costs of investing (meaning the ever-declining revenue from traditional investment vehicles in the "60" or the "40" categories), investors and investment advisors have been subjected to countless lectures about the need for more complex strategies than a simple allocation to stocks and bonds.

"Alternatives", or "Liquid Alternatives", as these strategies are known, may include market-neutral, long/short, macro-driven (managed futures), event-driven, commodity, or even distressed debt approaches to investing. We know of a firm that simply classifies these categories as "Hedge Funds" on their statements (though they are not, they are mutual funds). Thirty years ago, these strategies were the purview of hedge funds alone. One of the characteristics that made them work (when they worked) was a built-in illiquidity that allowed for the time factor to play its important role. Today-most have been nicely packaged into funds that comply with regulations (and daily liquidity requirements) of the Mutual Fund Act of 1940 to be delivered to the least-sophisticated investors among us, who are also perhaps least-equipped to understand the tactics, their purpose, or allocation and weighting justifications in their own portfolios. But of course, the trade-off to "upgrading" the portfolio is the inclusion of strategies that charge significantly higher fees to own. Expense ratios can range from 1.50% to 3.00% (even higher), compared to the passive alternatives of stocks and bonds (0.05%-0.20%).

We will pause here to inform you that CCR Wealth Management has made use of select "alternative" strategies in our Low Correlation Model portfolio since its inception 10 years ago (we have a full understanding of the underlying strategies, the limitations inherent in their "1940 Act" configurations and the impact of higher fees on the overall portfolio expense ratios). One of the responsibilities that we jealously guard in this capacity is that of gatekeeper or "goalie" to our client portfolios from the marketing departments of Wall Street.

We expect the drumbeat of obituaries for the 60/40 portfolio will become louder in the coming quarters-the reason being that many of these strategies far exceeded the return of a simple 60/40 allocation in the last 12 months, our Low Correlation Model included. But the past doesn't necessarily indicate prologue, in our view. In most cases, these alternative strategies have long track records of underperformance relative to the major asset class indices, punctuated occasionally with exceptions like 2022.

Our October Outlook indicated a renewed optimism in the outlook for the US bond market. In fact, you may have read that 2022 was the worst year for US bond returns ever-in history! This fact is certainly baked into your 2022 returns, and this fact will be the ammunition for the renewed, more aggressive push for investors to cast aside less expensive, simpler portfolios for the promise of continued outperformance-if you will only pay the higher fees. But 2022's bond market performance belongs to 2022 and is not at all indicative of likely performance going forward.

While we feel there is room for these strategies if utilized thoughtfully, we are also of the mind that the simple 60/40 allocation is now poised to deliver promising returns to investors without the complexity and expense the alternative universe adds. Indeed, given the carnage in both stock and bond markets last year (and the inherent valuation improvements in both), investors switching to these strategies may find they are closing the barn doors long after the horses have left. The last time stocks and bonds simultaneously performed this dismally (or close to it) was in 1931. Ultimately, strategy questions like this are best to reflect on with your financial advisor.

Economic cycles, market cycles, and business cycles advance and age on a continuum apart from the calendar year. So, while we have turned the page on the calendar, our themes from a year ago still hold sway in our investment strategy: Value over growth, large over small, quality over concept, and US over non-US. We would also reiterate our supposition from October that given the still-large swath of market participants looking for the Fed's next "dovish" turn (hope springs eternal), we expect the markets will continue to advance and retrace in a rather "trendless" saw-tooth pattern for much of the next two quarters. We agree with the bulls who say the Fed is closer to the end of its rate-hiking cycle than the beginning. But we find more value at this time in much of the bond market based on this outlook. Philosophically, CCR Wealth Management is more concerned with a favorable risk-adjusted return, relative to an equivalent return that comes with higher volatility. In our view, bonds check this box today. We think it is far too early to be anticipating Fed easing (don't fight the Fed). But bond yields today are as attractive as they were back in 2008, requiring less emphasis on central bank assistance in providing a return for this allocation of your portfolio-a state of affairs that has been missing for the last 24 months, at least.

We think the lag effect of interest rate hikes, and what we surmise will be the stubbornness of inflation will color the return pattern of the equity markets well into 2024. Recall that interest rate hikes, Fed minutes, and Fed speeches all tend to have an immediate impact on financial markets (intended by the Fed as "financial tightening", a part of the process). Near-immediate responses to these elements are seen in things like mortgage and credit card rates, with more-lagging effects on related housing prices and consumer spending. But the "hard" impact on the economy in the form of higher cost-of-capital can take many more months. It is this impact we anticipate showing up in earning reports in the first quarters of this year.

We often talk about the equity markets in terms of valuation, and we often use the relative P/E (Price/Earnings) relationship to describe these valuations. If we were to sum up our view of equities over the last 12 and the next 12 months, we would say 2022 was about the P, and 2023 will be about the E. Markets revalued on a massive scale last year, with loftier valuations feeling the most pain. Over the next two quarters, we will begin to surmise the impact on earnings. Similarly, we see 2023 as a year of transition, and 2024 as a year of normalization.

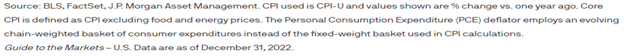

We also see evidence that business leaders are preparing for a significant economic slowdown. Two recent economic data points from December, the Non-Farm Payroll report (Dept. of Labor) and the Purchasing Manager's Index (Institute for Supply Management) illustrated conflicting signals. While 223,000 net new jobs were created for the month, a stronger-than-expected showing which inched the unemployment rate down to 3.5% from 3.6%, the ISM report (a forward-looking survey of business managers) showed significant disappointment for Services activity (49.6% down from 56.5% in November) and New Orders (45.2% from 56% in November). Both readings below 50 indicate a significant expectation of economic contraction expected by the business community. Even the labor statistic of 233,000 new jobs (a backward-looking data point), if we read beyond the headline, indicated large job losses in temporary jobs (-35,000) and administrative support (-28,000). Both categories tend to feel the first thrusts of wider job losses during economic downturns.

Our previous expectations of a "saw-tooth" pattern to broad equity indices will likely continue to be inversely tied to economic news (where markets rally on negative data points, in anticipation of rate cuts ahead, and decline on good economic data points, anticipating higher rates for longer).

If you're a regular reader of our Outlook, you will note that we do not construct this month's edition neatly into "Equity" and "Fixed Income" categories. This is because the influence of interest rates has blurred the lines (and erased the expected risk-premium distinctions of late). Interest rates are a response to the prickly conundrum of 40-year high inflation. The bulk of one's opinion of the economy, the equity markets, fixed income markets, and all manner of other assets in 2023, therefore, is tied to interest rate expectations, and ultimately to the path inflation takes going forward.

Forecasters of inflation must also adopt a robust sense of humility. Just ask Jerome Powell. And as we pointed out in our open, our own 2022 expectations for a large drop in inflation last year (correct, as far as it went) supposed this decline would be from the 7.00% (yoy) level--not 9.1% (yoy)! Today, we believe we can comfortably say that we are in a post-peak inflation environment. A year ago, "supply chain" was the buzzword du jour among media pundits, government officials, and investors. Since last summer, we have seen significant deflation in goods pricing of all stripes, from lumber to gasoline, along with the cost of most raw materials. Even exorbitant home prices which peaked last April have come down meaningfully in much of the country. The deflation we have seen in goods prices reflects, to a large degree, the final unsnarling of supply chains around the world.

The trickier, and likely more stubborn aspect of the current inflation picture remains on the service side. From haircuts to airline tickets, wherever labor (or the shortage of it) has been a major factor, prices will remain elevated for longer than any year-ahead outlook. We believe the market is missing this inevitability with the repetitive oscillation of expectations between elation (rate cuts) and despair. This is what we think the equity markets will struggle with in the quarters ahead, and frankly, what they have been struggling with in the two quarters behind. This is, in fact, the source for our envisioned saw-tooth pattern in broad-based equity indices.

Another note about inflation all investors should heed. The most often quoted measurement of inflation is year-over-year growth of prices. While we have outlined the bifurcation between goods and services above, keep in mind that prices could hold steady here for months-and inflation pressures will seem to ease because of this year-over-year fixation. In other words, expect inflation rates to ease-even if prices do not come down. Similarly, stock and bond prices could freeze at current levels for six months, and your year-over-year portfolio return would seemingly improve (vs. previous time measurements). That doesn't mean you have retraced any lost ground. It simply means comparisons become easier. In fact, it is a long way from December's 6.5% CPI report to the Fed's preferred 2.0% target. And most of this 4.5% differential is enmeshed in the labor markets. Thus far, the "pain" Jerome Powell referred to back in August is not yet evident in the economy. Again, in our view, expectations of a rate cut by the Federal Reserve anytime in the near term are misplaced. But hope continues to spring eternal.

One last example of this lag-effect in the inflation measure: "Shelter" inflation (owner-equivalent rent), a proxy for the impact of shelter costs on CPI will remain murky, in our view. While we have seen some easing in housing prices, rental leases renew annually. A lease signed last February will probably show a much higher rent in its renewal this February (even though CPI has come down over the last 4 months). On the other hand, the Case-Schiller home price index is an appraisal-based index that assumes 12 monthly adjustments. Home prices peaked last April, so the inflation influence on CPI will likely drop off afterward. Will labor costs subside commensurately? Hope springs eternal.

Lastly, and in keeping with our optimism about the bond market in the nearer term, we are reminded of the Loss Aversion biases of Behavioral Finance which cause investors to make sub-optimal decisions. Understandably, investors distraught with portfolio returns in September and October were enticed by the widely "advertised" bond yields of 1 and 2-year Treasury notes greater than 4%. Today, our "core" bond funds show 3-month returns ranging from 4.9%-5.4% (and we feel this rally is just getting started). At least half of these returns are the result of higher yields available in the bond markets over the last 6 months. These funds are not equivalent to a risk-free rate in T-notes, of course, but investors should consider the opportunity cost of locking in low (even if risk-free) rates just because markets are cloudy.

2022 we dubbed a Year of Change. 2023 we anticipate will be a Year of Transition. And while we look forward to 2024 as a Year of Normalization, as investors we recognize that plans are useless, but planning is essential. Please do not hesitate to contact your financial advisor if you would like to speak directly with your advisor or a member of the CCR Wealth Management Investment team if you would like to further discuss topics in this outlook.

© 2023 CCR Wealth Management, LLC

The views are those of CCR Wealth Management LLC and should not be construed as specific investment advice. Investments in securities do not offer a fixed rate of return. Principal, yield and/or share price will fluctuate with changes in market conditions and, when sold or redeemed, you may receive more or less than originally invested. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Investors cannot directly invest in indices. Past performance does not guarantee future results. Additional risks are associated with international investing, such as currency fluctuations, political and economic stability, and differences in accounting standards.

Registered Representatives offering securities and advisory services offered through Cetera Advisors LLC, member FINRA/SIPC, a broker/dealer and Registered Investment Adviser. CCR Wealth Management and Cetera are affiliated. Cetera is under separate ownership from any other named entity. Cetera Advisors LLC does not offer tax or legal advice.

CCR Wealth Management 1800 W. Park Drive, Ste 150, Westborough, MA 01581. PH 508-475-3880 / 72 Queen St, Southington, CT 06489. PH 860-370-2270

The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe and is a subset of the Russell 3000 Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values.

Crypto-Currencies, Digital Assets and other Block-Chain related technology (such as Bitcoin, Ethereum, NFTs and others) are not securities, not regulated, and not approved products offered by Cetera Advisor Networks LLC. Crypto-currencies and other block-chain related non-securities products cannot be recommended, offered, or held by the firm.

Some alternative investments involve a high degree of risk, and returns can be volatile. Investing in an alternative investment may only be suitable for persons who are able to assume the risk of losing a portion or all of their entire investment.

Mutual Funds and Exchange-Traded Funds are sold only by prospectus. Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained directly from the company or from your financial professional. The prospectus should be read carefully before investing or sending money.