Summer: Great Time to Teach Kids About Money

July is National Make a Difference to Children Month, which is a great time to teach your kids about money!

Tax & Estate Strategies For Married LGBTQ+ Couples

Learn how to maximize your tax and estate strategy as a married member of the LGBTQ+ community!

Revisiting Elder Care Issues

Existing financial, health care, and living arrangements that were satisfactory at age 65 often require a second look.

The Role of Caregiver Affects Women Differently

Caregiving can affect women’s professional advancement at work, as well as their ability to save and plan for retirement.

5 Estate Considerations For The LGBTQ+ Community

LGBTQ+ couples face particularly complicated issues when establishing a workable estate strategy.

401(k) Rollovers Can Make or Break Retirement

Coaches, understanding the value of rollovers is essential to preserving a secure & organized financial future.

Older Americans: Growing Targets of Financial Fraud

Older generations grew up in a world where it was customary to be courteous and trusting. Unfortunately, this often puts them at greater risk for financial fraud.

Countdown to Retirement

Many people age 50 and older haven’t begun to save for retirement or have yet to accumulate sufficient funds. It’s not too late to take charge.

America’s Changing Vision of Retirement

As you prepare and save for retirement, give some thought to the kind of retirement you envision for yourself.

How to Minimize Taxes During Market Downturns

Market downturns could be a good time to adjust your fund portfolio to minimize the tax bite. Here’s how to calculate the best ways to do that – now and in the future.

Protect the MVP with Disability Insurance

Coaches, being on the field is key to your team’s success. Having sufficient disability insurance could be key to your family’s success. When was the last time you reviewed your disability insurance?

2023 Annual Tax Guide

Learn where your tax dollars go, some of the ways tax filing may look different, and what you can do to prepare.

Solidify Your Future with Disability Income Insurance

Have you considered how you’d pay your bills and daily expenses in the event of a disability?

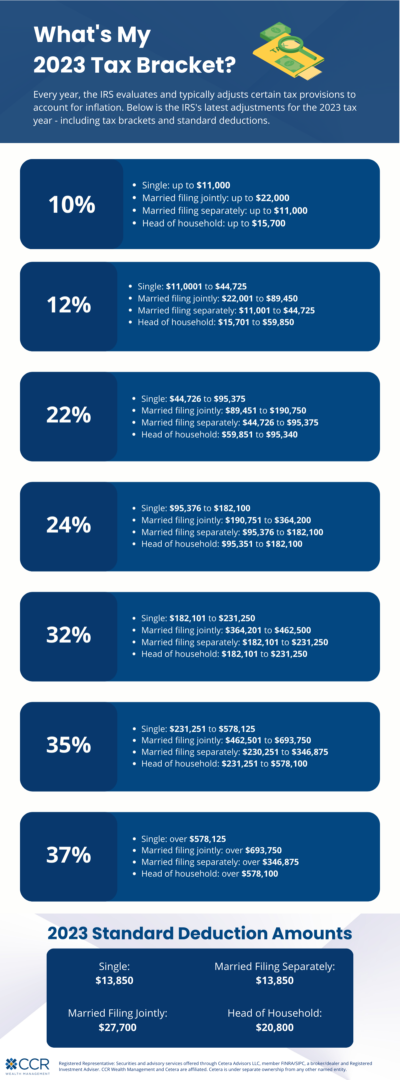

What’s My 2023 Tax Bracket?

Do you know what 2023 tax bracket you fall into? If not, find out using this guide.

Celebrating Black History Month: Be Healthy

Regularly checking your net worth helps you assess where you are, measure your progress toward your goals, and build a financial plan.

Roth vs Traditional 401k

Retirement Consultant Mike Callahan reviews the differences between Roth and Traditional 401(k)s in our latest educational video.

Moving Your 401(k) to Roth IRA Tax-Free

When you retire, you can roll after-tax contribution money into a Roth IRA on a tax-free basis. But, there are some important caveats.

Assessing Your Retirement Resources

Will your retirement money come from Social Security, employer-sponsored plans, or personal retirement savings? Each offers important resources that can help you fund the lifestyle you seek in retirement.