June 2021 Market Outlook

Here’s a brainteaser: Do you consider the current market cycle (begun after last-March’s pandemic-induced bear market) a new market cycle? Or a continuation of the last market cycle (begun after the great recession of ’08-’09)?

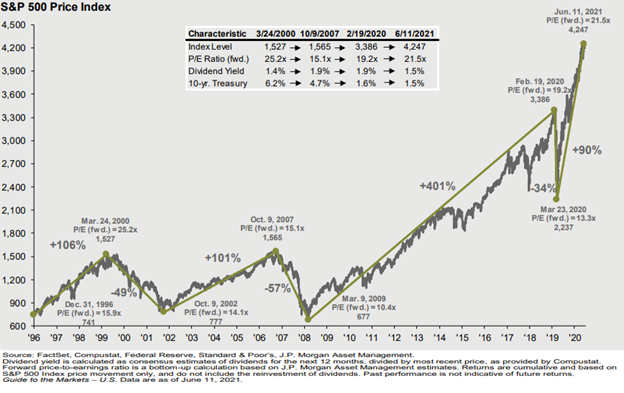

There is a technical answer, of course, one which we defined in our Outlook last April. A market cycle is bracketed by bear markets, declines in major indices (usually defined with the S&P 500) of 20% or more. So, on that basis, we are a little over a year into this new market cycle. Given the quick action of the Fed along with fiscal provisions from government, the bear market of 2020 was so quick that you missed it if you blinked, as the chart below shows.

Unlike previous recessions, the US saw no massive layoffs, though there was plenty of labor displacement. Eviction moratoriums and loan forbearance kept people in their homes and many businesses above water, while government checks and UI enhanced benefits replaced lost income. We ask this question as a thought experiment to help us understand nuances and, indeed, contradictions present in the current market.

Consider this: market cycles in their late stages are marked by slowing growth, higher inflation, and higher equity valuations. In these environments, outperforming sectors tend to be utilities, energy, consumer staples and healthcare. Value tends to outperform growth.

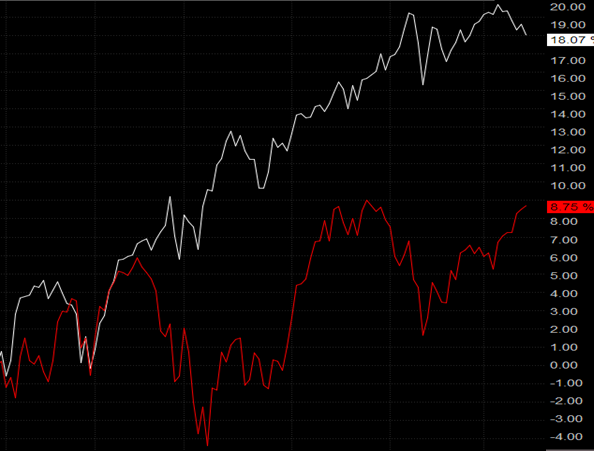

Right now, our environment is marked by many of these conditions despite the young age of the cycle.. Certainly, we have seen much higher inflation figures lately—with May CPI having risen 0.6% from April, and 5.00% from a year ago (more on inflation below). Value stocks are outperforming growth stocks on a year-to-date basis (Russell 1000 Value ETF in white, Russell 1000 Growth ETF in red):

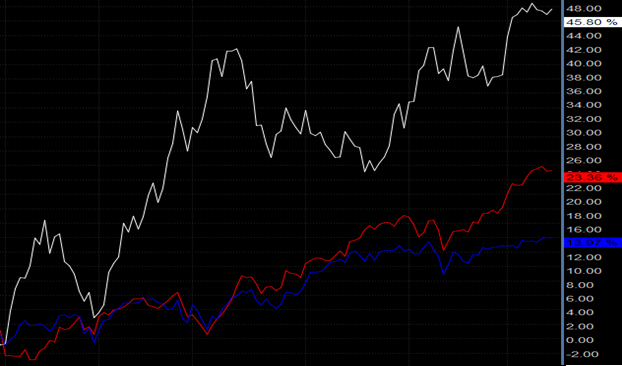

And in terms of sector performance, we can see that energy (white) and REITs (red) are handily outpacing the S&P 500 (blue):

While healthcare lags the S&P slightly year-to-date, it outperforms large-cap growth.

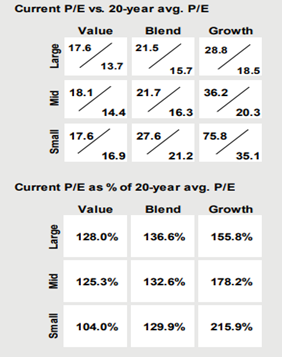

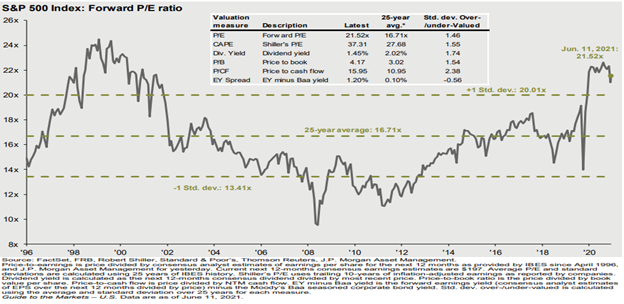

Lastly, stock valuations seem anything but cheap. The S&P 500 trades at nearly 1 ½ standard deviations above its 25-year average, with wide dispersions among sectors, some of which trade at twice their longer-term averages. This affliction affects all market caps and styles.

So, what is going on here? Are we in a late-stage cycle marked by inflationary pressures, value stocks in the lead, all possibly signaling danger ahead? Or are we in the nascent stages of a new bull market—barely a year old, and with Fed Funds rate still pinned to zero?

Our view of this situation is grounded in imaging the economy being “flash-frozen” last March and April. Economies were forcefully shut down. Incomes were immediately replaced by “enhanced” unemployment benefits. Loan provisions were set up by the Federal Reserve and the Cares Act which kept many mid and large-size businesses afloat (unfortunately, too many smaller businesses have since failed) and forbearance policies, both voluntary and mandated, were put in place to stave-off bankruptcies. Our economy was held in a state of suspended animation while we waited for our infection numbers to drop, our emergency rooms to clear. And while our affliction from COVID has significantly declined, vaccines distributed, and death tolls plummeted, our economy reopened.

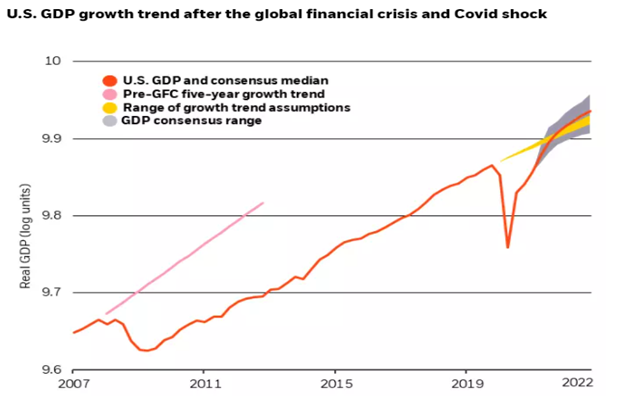

The ice having been melted, the bounce back from the COVID shock has been remarkably swift. A recent mid-year outlook from BlackRock:

“…this is a restart, not a usual business cycle recovery. This is in stark contrast to the global financial crisis (GFC) and the “lost decade” that followed. Median forecasts now point to a period of above-trend growth of the U.S. economy, according to the latest Reuters poll…This is unusual, as typically growth takes time to pick up to trend again after a downturn.

The bigger question: What lies beyond? Views among forum participants differed on whether the restart is the start of a broader pickup in animal spirits, the acceleration of trends that boost potential growth, or a return to something more like a typical mid- or late-cycle. Many saw U.S. inflation exceeding the Fed’s target in the medium term – a big turnaround from the tepid inflation expectations of a year earlier. The BlackRock Investment Institute (BII) sees U.S. CPI inflation averaging just under 3% between 2025-2030, and believes this is still underpriced by markets.”

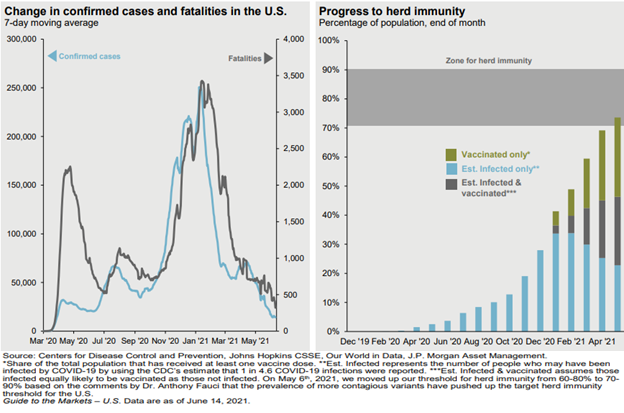

Coming up on the half-way mark in the year, the S&P 500 is already in double-digit territory, this occurring after two back-to-back double-digit years. Market breadth has broadened out such that we no longer have the same handful of gargantuan tech companies driving the indices higher. Roughly 70% of the US population has had at least one vaccine shot, and COVID cases in the US have plummeted since the beginning of the year. These points, in addition to the warm June days we thought would never come, have us feeling pretty good. But it seems there sure is a lot of worry to go around.

We spoke with a client a couple weeks ago who was, in his words, thinking about ways to protect his portfolio from the coming “taper tantrum”.

Flash back: the year was 2013, and the federal Reserve was chaired by Dr. Ben Bernanke. In answer to a lawmaker’s question during congressional testimony in May that year, Bernanke uttered these words: “If we see continued improvement and we have confidence that that’s going to be sustained then we could in the next few meetings…take a step down in our pace of purchases”. Que the tantrum: Bond yields rose dramatically (ten-year Treasury yields rose 50% in the ensuing weeks), CBOE volatility indices rose 18%-30%, and stocks sold off. Not far (~5% or so on the S&P 500), but quickly, violently. At the time, we remarked in our Outlook that Fed’s comments were simply “inartful”. Today, we are once again beholden to helicopter money, so the question is understandable.

But we are always preparing to fight the last battle, aren’t we?

Little “micro events” that occur throughout the market cycle are often nicknamed, which the media picks up and then beats into the ground. We have “taper tantrum”, “meme stocks”, “disruptors” and “flash crash” to name just a few. We are constantly on guard for the recurrence of these one-time surprises. Being constantly on the lookout for the same surprise pretty much ensures it will never happen-we are preparing to fight the last battle. The significance of the “taper tantrum” was that no one was expecting Bernanke to muse about the end of quantitative easing in front of Congress.

Today—by our casual survey of media, fully half the commentators we have listened to or read over the last few months expect inflation to be a problem a year or even three from now, and the Fed to begin withdrawing the punchbowl as early as next year.

Inflation:

One battle that some of us have fought in this lifetime is that against inflation. The topic gains a lot of interest because inflation can be an economy killer—and a portfolio problem, and we are now seeing inflation figures in this country not seen since 2008 (CPI, recently released at 5% in May), or even decades earlier with Core Inflation (CPI, less food & energy, recently released at 3.8% in May). But let us not lose sight of the fact that the reason most investors put their hard-earned money into risky assets like stocks is for the purposes of beating inflation. Having handily beaten inflation over the last decade, we are confident none of our clients’ financial futures are at risk from a little near-term inflationary pressure.

The United States economy has re-opened at a faster pace than most economists expected at the beginning of this year, and at a much faster pace than the rest of the world. This is clearly due to a combination of Warp Speed’s rapid development of a COVID vaccine, and an aggressive push the get “shots in arms”. It is natural and expected that inflation readings this Spring show a major bounce back from last Spring’s deep freeze. But it is equally important that we do not confuse the rate of price changes measured from a trough to today with that of a more permanent acceleration in inflation caused by a broader rise in commodity prices that is sustained over many years. The media seems to like to explore the latter scenario (if it bleeds it leads), while the Federal Reserve has made it clear they will be patient with “transitory” high rates of price change in the near term. We see no reason to ignore the Fed and embrace the narrative at this juncture.

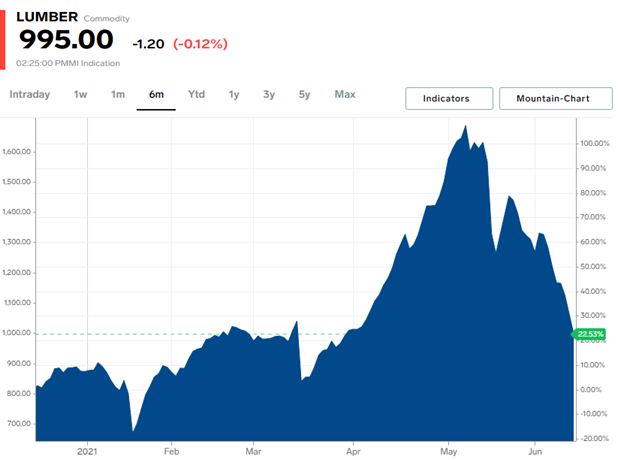

We imagine a scenario where inflationary pressures “roll” through the economy as our reopening becomes complete. Early this Spring, the big story was about lumber prices, and their effect on housing prices—even housing starts (some builders paused construction due to the skyrocketing prices).

As we can see from the above chart, we have seen much of this price-spike roll off already. As high prices weaken demand, inflation takes care of itself. As much as one-third of the annual CPI increase in May was due to new and (mostly) used car and truck prices. Global chip shortages have hamstrung new vehicle production, thus driving up used vehicle demand. We do not think the global supply-lines which have impacted semi-conductor production remain impaired for years. As economies reopen around the world, we expect supply-chains to normalize, and these inflation spikes to dissipate—though they will roll through most of the economy in the short run.

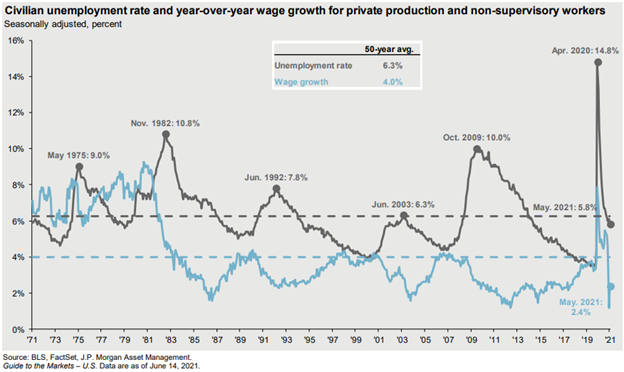

Wage inflation, in our opinion, is worth watching. In our April Outlook Zoom chat, we discussed the spectacular March job-creation numbers (916,000 jobs gained for the month). We also expressed skepticism that this would become a trend, due, in part, to the extension of enhanced unemployment benefits into September. Sure enough, both the April and May jobs numbers have been a disappointment. That said, we have all likely seen a myriad of small businesses desperately looking to hire. Will wages rise above the government-provided incentives to stay home? Will the biggest jobs numbers of the year come in September or October? We cannot predict the future, but our supposition is that the tightness in the labor market begins to ease this fall.

A last word on inflation: The media is fixated on a return to 1970’s-era inflation. Such high inflation caused economic stagnation around most of the world, and a repeat of this decade is rightly feared for those who lived and worked through it (about half our clientele, roughly). We touched on this topic as well in April and pointed out that there were circumstances in place then that do not shape global economies now. “Guns ‘n’ Butter” (Vietnam + Great Society) of the 1960’s, Nixon’s wage and price controls, the Arab oil shock (’73) followed by the Iranian oil shock (’79) created an environment in which an economy reliant on foreign oil would spiral into inflation while awash in cheap money. While some might reach for parallels today (fiscal stimulus, Fed funds), we would point out that the path out of stagflation is known now (Paul Volker having shown the way). Additionally, the technological advancement of developed economies as well as the relative globalization of supply chains (both are deflationary forces) keeps us highly skeptical of a return to the 1970’s. That said, CCR Wealth Management recognizes that inflation is an element that can be driven by expectations as much as fundamental economic imbalances. While we are highly skeptical of the 1970’s scenario, and we find no reason to doubt the Fed’s intention to stick to their guns, we view labor shortages and their upward pressure on wages as having the biggest potential to feed into higher inflation expectations in the near future.

Model Portfolios:

As we have conceded, while the current bull market is in comparatively early stages, we look at the environment as mid-market cycle. This environment suggests benefits to broader diversification—both within markets, and globally.

We outlined our transitioning from a heavy-to-light growth vs. value lean in our January Outlook, and we continued this transition through all accounts in the first quarter. Our most recent model adjustment is a revisitation of developed non-US equities, but entirely focused on Europe. European vaccine creation, vaccination and COVID-case declines have all lagged the US considerably. We recognize, however, that the good news which has been embraced in the US will indeed occur in Europe. We have made mention recently the difficulty of actually finding any meaningful value in broad US indices. Companies and sectors which were devastated during the lockdowns of 2020, and whose markets have yet to fully recover, are trading at significant multiples of their pre-COVID valuations!

We look to Europe, via a broad-based and cheap ETF, at 15% of our equity allocation, to provide this comparative value, and thus, diversification. We feel better days are ahead for the region in terms of reopening, and the FTSE Europe index trades at 21.48 x earnings, compared to the S&P 500 which currently trades above 26x earnings.

With regards to fixed income, we have no changes to convey, though we are happy to report that year-to-date all CCR Wealth Management’s major fixed-income tools (core bond funds as well as “satellite” additions to core holdings) have performed well relative to the Bloomberg Barclays Aggregate Bond Index (which is down almost 2% YTD). We have added marginally to TIPs and Emerging Markets Debt moderately throughout the last few months.