Money Myth: Investing is Only for Men

Women have historically invested less than men, but as women educate themselves, they have the power to redefine this narrative. By investing in your knowledge, you not only empower yourself but also become a role model for others, driving significant change for future generations of women.

Understanding the Financial Landscape for Women

Women often face unique obstacles on their financial journeys:

- Pay disparity: Among workers who have a college degree, women are paid nearly 27% less than men.

- Career breaks: LinkedIn’s LinkedIn's Economic Graph team found that 43% more women in the U.S. have a career break listed on their resume compared to men.

- Investment gap: Although the trend is shifting, various studies show that women invest less than their male counterparts.

Taking Control of Your Financial Future

Finances can often feel overwhelming, but education replaces confusion with confidence.

Women historically invest less than men, but the more women learn, the more they can change this narrative. Financial education is the key to breaking the cycle of financial uncertainty and creating a future of empowerment.

By investing in your knowledge, not only can you empower yourself, but you can also become a role model for others, helping shift the landscape for future generations of women.

Building Wealth: Step-by-Step

Why Invest?

Investing is about making your money work for you.

Outpaces inflation: Investments like stocks and bonds generally outperform inflation in the long term.

Compounding power: When you invest, you not only earn returns on your initial investment but also on the returns themselves. The longer you invest, the more your wealth can grow.

Pursue long-term goals: Whether it’s retirement, buying a home, or funding education, investing allows you to build wealth that can help you pursue these long-term goals.

The Power of Preparing for Life Events

Investing isn’t just about growing wealth—it’s about preparing for life’s milestones and building the resources you need to confidently pursue the life you desire.

Whether it’s retirement, buying a home, starting a business, sending your kids to college, or all of the above, having a long-term plan to build wealth can help you work toward the outcomes that matter most to you.

The Stock Market: A Tool for Investing

The stock market is where investors buy and sell shares of ownership in companies.

When you buy a share, you own a small piece of the company. As that company grows and becomes more profitable, the value of its shares can increase, meaning your investment can grow over time.

Understanding Stock Market Fluctuations and Growth

While the stock market may experience volatility, historical trends demonstrate that you can typically trust the market to increase the value of your investments over time. Here are a few reasons why:

- Companies increase profits as they grow and expand, which drives higher stock prices.

- Reinvestment of earnings into innovation and business development, fuels further growth.

- The broader economy’s growth, which supports the growth of businesses and industries.

Overcoming Emotional Investing Decisions

Market volatility can evoke emotional responses, but it’s crucial to keep the bigger, long-term picture in mind.

The Power of Long-Term Investing

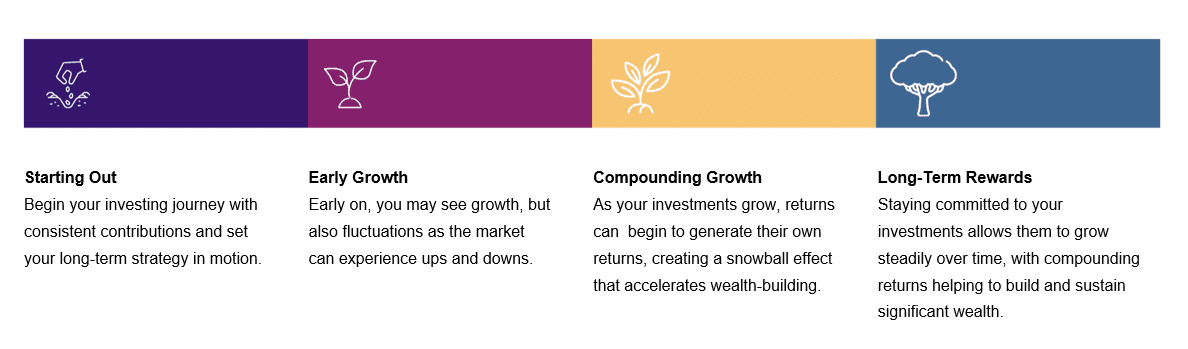

Investing for the long term is a strategy designed to build wealth gradually.

- Compounded growth: By staying invested over the long term, your money has the opportunity to grow over time as your earnings generate additional earnings.

- Staying the course: The market will always have ups and downs, but staying invested helps you benefit from long-term growth.

- Benefits of patience: Long-term investing allows you to weather market volatility, giving your investments time to recover from downturns. Stay focused on future goals rather than short-term fluctuations.

Managing Risk vs. Return

Investing is about balancing the potential for higher returns with the risks you’re willing to take. Each investment type has its own level of risk.

Diversifying your investments, setting clear goals, and reviewing your portfolio regularly are key strategies to control risk while pursuing higher returns.

Understand Your Options

There are various ways to invest. Here’s a breakdown of some common investment vehicles:

- Stocks: Can provide high returns but come with greater risk. Stocks are ideal for long-term growth but can fluctuate.

- Exchange-Traded Funds (ETFs): A diversified investment that tracks an index. It offers a more conservative balance between risk and reward.

- Mutual funds: Managed portfolios that pool money from many investors to invest in various assets. They offer diversification and can help mitigate risks but may have higher fees.

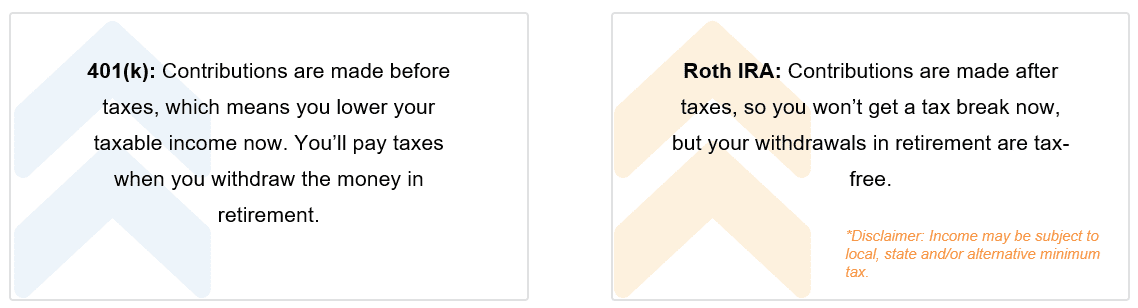

How Taxes Affect Your Investments

Taxes on your investment returns—like interest, dividends, or capital gains—can impact the growth of your money. Choosing the most appropriate account for your situation can help minimize taxes and maximize your investment returns. Using tax-advantaged accounts, like a 401(k) or Roth IRA, can also allow your money to grow more efficiently.

Next Steps: Work with a Financial Professional

Starting your investment journey can feel overwhelming, but you don’t have to do it alone. A financial professional can help you:

- Identify your short- and long-term financial aspirations and turn them into specific, time-based goals

- Develop a plan and a personalized investment strategy that’s aligned with your goals, values, and risk tolerance.

- Gain clarity and confidence through education, tailored support, and a clear plan.

- Work toward financial independence with actionable steps and ongoing guidance.

When you're ready to get started, reach out for personalized advice and guidance.

Disclosures:

Securities and advisory services offered through Cetera Advisors LLC, member FINRA/SIPC, a broker/dealer and Registered Investment Adviser. CCR Wealth Management and Cetera are affiliated. Cetera is under separate ownership from any other named entity.

A diversified portfolio does not assure a profit or protect against loss in a declining market.

Investors should consider the investment objectives, risks, and charges and expenses of the funds carefully before investing. The prospectus contains this and other information about the funds. Contact the investment company to obtain a prospectus, which should be read carefully before investing or spending money.

For a comprehensive review of your personal situation, always consult with a tax or legal advisor. Neither Cetera nor any of its representatives may give legal or tax advice. There is no assurance that the techniques and strategies discussed are suitable for all investors or will yield positive outcomes. The purchase of certain securities may be required to effect some of the strategies. Investing involves risks, including possible loss of principal.

Sources:

- https://www.epi.org/blog/gender-wage-gap-persists-in-2023-women-are-paid-roughly-22-less-than-men-on-average

- https://www.linkedin.com/news/story/how-career-breaks-differ-for-women-6382769/

- https://money.usnews.com/financial-advisors/articles/women-and-investing-statistics-show-progress-not-parity

- https://www.nasdaq.com/articles/heres-the-average-stock-market-return-over-the-last-15-years

Follow us on social media for more timely content delivered directly to your news feed!