March 12 Market Update

Volatility is a natural component of investing. A smooth, straight line “from the bottom left to the upper right” has never existed. In fact, without periodic recalibration, we would be investing in a market where 150% P/E ratios are the norm. Ultimately, in such a world, earnings mean nothing.

The stock market(s) have produced back-to-back 25%+ returns since the beginning of 2023. To think a period of “give-back” might not occur before new highs are made would be, well, naïve. Our three decades of experience have included several such occurrences.

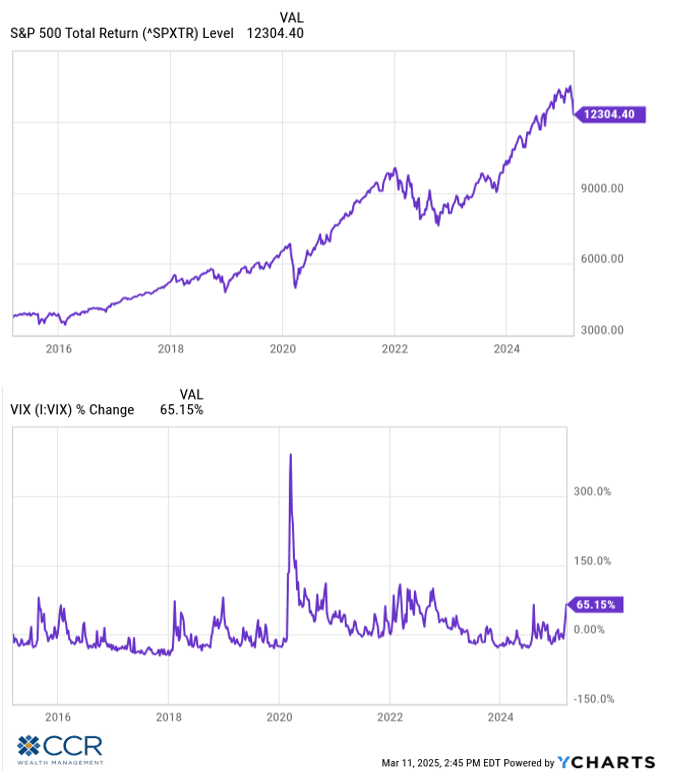

Above, we have embedded a chart of the 10-year total returns of the S&P 500 above a 10-year chart of the CBOE VIX index, a measure of implied equity volatility. Ask yourself if you wish you were a net buyer—or seller of the S&P 500 given the spikes in the VIX index below.

Oh—every bout of volatility came with its own explanation, its own “narrative”. We spoke about the “on the heels of…” fallacy in our most recent Outlook. There was the “growth scare” of late 2018, then, of course, the pandemic of 2020, soaring inflation (and interest rates) of 2022, and lots of little stories in between.

Speaking for ourselves again, no one can accuse us of cheerleading the rise of the “Magnificent Seven”, in defiance of all reasonable and empirical evidence that valuations matter. The large-cap growth universe within the stock market closed out last year, trading at 150% of their 20-year average P/E. No—this time it isn’t different (it rarely is). At these valuations, perfection is expected. But perfection is rarely delivered in reality. Investors are being retaught an age-old lesson. Valuation matters.

Evidence of economic slowing has been with us for a year now. Real Wages began to contract last February. The housing market has been an economic low-light for a year, and sentiment indices (surveys) have been warning about inflation and economic concerns. To add to this conflagration comes the “element of surprise”…always there to dislodge investors from their long-term strategies.

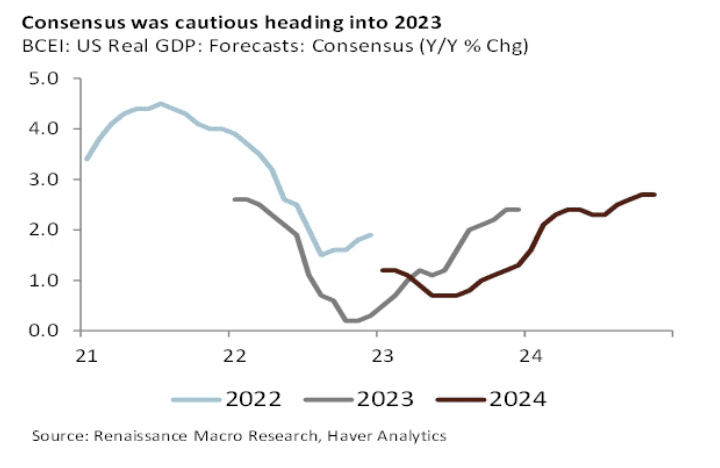

Note how the consensus for US GDP was very cautious (expecting recession) going into 2022 and 2023. Of course, a recession never happened. Coming into 2025, however, everyone was on the same page! That is, recession risk was a distant outlier just a month or two ago.

Now, the media is shouting “Recession!” from the rooftops. For our part, we think a soft landing is the base case even though recession risks have risen. To borrow a tagline from Jim Cramer: “There’s always a bull market somewhere!”. If you traded in your bond portfolio for a certain chip maker, you may be chagrined to learn that the Bloomberg U.S. Aggregate Bond* is over 6% ahead of the S&P 500 year to date (and almost 12% ahead of the Philadelphia Semiconductor index!). Again, if you swapped your diversified portfolio for a bet on “AI”, note that European markets are nearly 19% ahead of US Markets over the last three months. China? Chinese tech is up almost 25% year-to-date.

CCR Wealth Management views the current bout of market volatility as a normal process of pressure-relief for a market that has been burdened by excessive valuations, particularly concentrated within heavily represented tech stocks. While recession is always a possibility, we expect aggressive monetary easing by the Fed in the near term. Tariffs, on the other hand, look to us to be a tool being wielded by politicians to extract particular outcomes. As such, their persistence will likely have a very high correlation to the politicians’ sense of career self-preservation. While Tariffs dominate the news today, they should not dominate investor decisions!

Disclosures:

Bloomberg U.S. Aggregate Bond – The Bloomberg U.S. Agg Total Return Value Unhedged, also known as "Bloomberg U.S. Aggregate Bond Index," formerly known as the "Barclays Capital U.S. Aggregate Bond Index," and prior to that, the “Lehman Aggregate Bond Index,” is a broad-based flagship benchmark that measure the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

Philadelphia Semiconductor Index- The PHLX Semiconductor Sector is a capitalization-weighted index comprising the 30 largest U.S.-traded companies primarily involved in the design, distribution, manufacture, and sale of semiconductors. It was created in 1993 by the Philadelphia Stock Exchange, which is now owned by NASDAQ.

Follow us on social media for more timely content delivered directly to your news feed!