A Comprehensive Guide to Tax Intelligent Planning 2025

Many people feel uncertain about how or when they will retire.

A recent study showed that 68% of workers feel confident they will have enough money to live comfortably in retirement, meaning plenty of people (32%) feel uncertain about retirement. Another study found that 16% of Americans now plan to retire later than originally planned. [1]

The big question: "How much of your money can you keep?"

The way you withdraw from your accounts during retirement can significantly impact:

- How long your money lasts

- How much you pay in taxes

- How high your taxable income is each year

Without a strategy, taxes can significantly reduce your income.

No matter how near or how far it may be, take a moment to think about your ideal retirement. Ask yourself:

- How modest or ambitious are my plans?

- How will I spend my time?

- What does my ideal monthly income look like?

Write down any details that stand out, as well as any questions or concerns that come to your mind.

What is retirement income planning?

When you’re in retirement, the focus shifts from saving to spending, and how you spend matters.

Retirement income planning is about understanding your sources of income and how to manage that income over time. A tax-efficient plan can help you turn your savings into a more sustainable income stream while minimizing your tax burden.

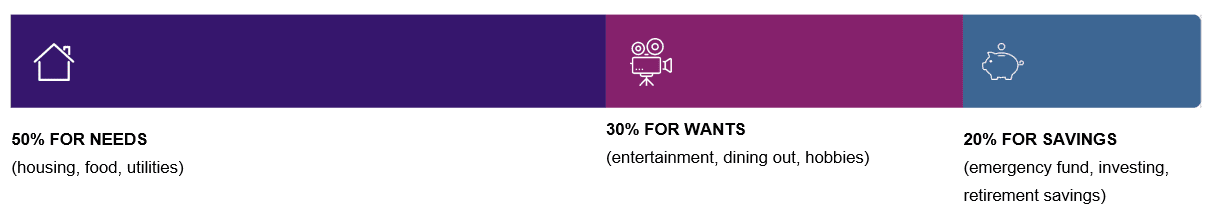

Build a Budget

For those building wealth or nearing retirement, building a budget can help ensure that your needs are met and that you’re taking proactive steps toward building wealth and the future you want. Consider the 50/30/20 rule, which suggests allocating your budget as follows:

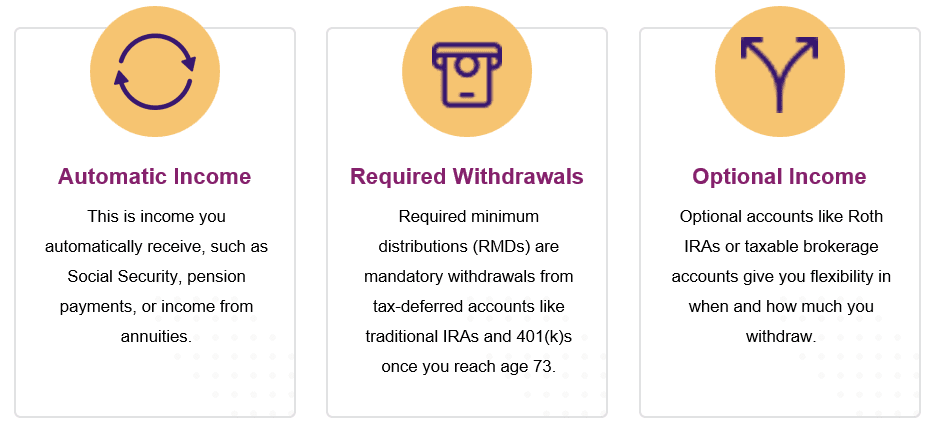

Understanding Distributions

In retirement, how and when you take money from different accounts can greatly impact your taxes and how long your savings last.

By understanding how different accounts are taxed, you can create a withdrawal strategy that minimizes your tax burden and maximizes your savings.

By understanding how different income sources are taxed, you can create a withdrawal strategy that minimizes your tax burden and helps your savings last longer.

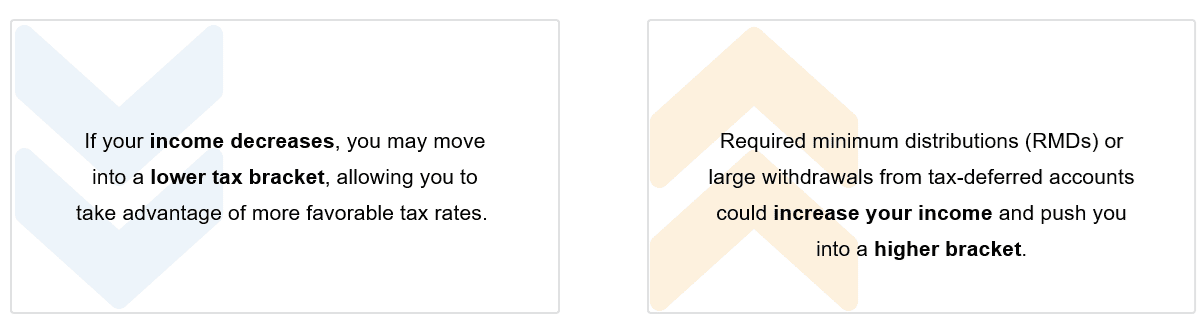

Managing Taxes is Key

Taxes can be one of the bigger expenses you’ll face in retirement. With a tax-efficient approach, you can potentially:

- Avoid higher tax brackets

- Reduce unnecessary taxes

- Keep more of your savings

Every dollar paid in taxes is a dollar less for your retirement needs. The more efficiently you manage your taxes, the longer your savings could last.

Most importantly, know that retirement often brings changes to your tax bracket.

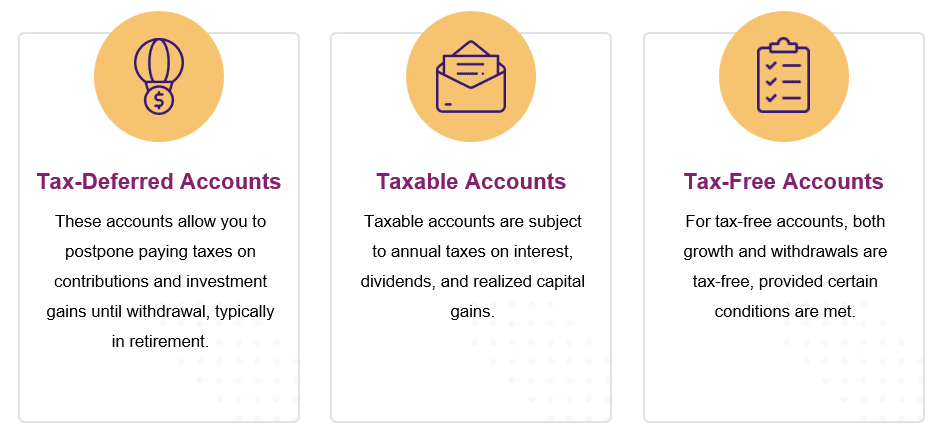

The Power of Tax Diversification

Having a diversified tax strategy in retirement is crucial for managing taxes effectively. By spreading withdrawals across tax-deferred, tax-free, and taxable accounts, you can help control your tax liability and optimize income:

- Tax-deferred: Traditional 401(k), Traditional IRA

- Tax-free: Roth 401(k), Roth IRA

- Taxable: Brokerage accounts

5 Strategies for Tax-Smart Investing

Planning your investments with taxes in mind can make a big difference in how much of your wealth you get to keep.

- Choose the Appropriate Investment Vehicles

By understanding how different income sources are taxed, you can create a withdrawal strategy that minimizes your tax burden and helps your savings last longer.

- Consider Tax-Efficient Assets

Some assets are inherently more tax-friendly than others. Here are three types of tax-efficient assets to consider:

- Municipal Bonds (Muni Bonds) offer tax-free interest income at the federal level, and often at the state level if you live where the bond is issued.

- Exchange-Traded Funds (ETFs) typically don’t trigger taxes until you sell the shares.

- Tax-Managed Mutual Funds are specifically designed to minimize taxable distributions

- Manage Capital Gains

Capital gains are the profits you make when you sell an investment for more than you paid for it.

Timing matters. Capital gains are taxed based on how long you’ve held the investment. Selling too soon could trigger higher taxes, while waiting a year or more can enable you to benefit from the lower long-term capital gains tax rate.

Being patient can help you keep more of your profits in the long run.

- Manage Distributions

In retirement, distributions can significantly impact your taxable income. By strategically managing how and when these distributions occur, you can reduce your tax burden.

High-Dividend and Interest Investments

Assets that generate substantial dividend or interest income can push you into higher tax brackets. Consider limiting exposure to these investments or reinvesting dividends to avoid taking distributions that increase your taxable income.

Complex Investments

Real estate holdings or business income can result in substantial distributions. By utilizing tax-deferred vehicles, such as IRAs or other qualified accounts, you can strategically manage the timing of these distributions to optimize tax benefits.

Income Smoothing

Income smoothing is a strategy that involves spreading out taxable withdrawals over multiple years to prevent sudden spikes in taxable income.

The benefit is that it helps you potentially avoid higher tax brackets, increased Medicare premiums, and taxes on Social Security benefits, and can reduce your overall tax burden in retirement.

- Harvest Losses

Tax-loss harvesting is the practice of selling underperforming investments to realize losses, which can then be used to offset capital gains and reduce your overall tax liability.

After selling a losing investment, you can reinvest the proceeds in a similar asset.

Be mindful of the IRS wash sale rule, which prohibits repurchasing the same or substantially identical security within 30 days.

The Take Away

By understanding how different income sources are taxed, you can create a withdrawal strategy that minimizes your tax burden and helps your savings last longer.

Disclosures:

Securities and advisory services offered through Cetera Advisors LLC, member FINRA/SIPC, a broker/dealer and Registered Investment Adviser. CCR Wealth Management and Cetera are affiliated. Cetera is under separate ownership from any other named entity.

For a comprehensive review of your personal situation, always consult with a tax or legal advisor. Neither Cetera nor any of its representatives may give legal or tax advice. There is no assurance that the techniques and strategies discussed are suitable for all investors or will yield positive outcomes. The purchase of certain securities may be required to effect some of the strategies. Investing involves risks, including possible loss of principal.

Follow us on social media for more timely content delivered directly to your news feed!